Amd shares rise again after his deal with samsung

Table of contents:

AMD recently held a strong presentation at Computex, showcasing upcoming products that surprised investors, and a few days later announced a new partnership related to its Radeon and Samsung graphics.

AMD had another 8% rise in its shares

One of AMD's biggest skeptics has been Morgan Stanley lately, underestimating the ads and putting AMD in a low price for quite some time. Today, the Morgan Stanley equity analyst finally admitted that the company was wrong about the chipmaker with a note to investors that it said (in part):

'' Obviously, being cautious about actions has been a wrong decision, even though we were right in some ways. While our concerns about earnings in the past 12 months have materialized…. AMD is well established by 2020 and there are positive catalysts in the short term, '' wrote Joseph Moore of Morgan Stanley.

Visit our guide on the best processors on the market

The bank raised its target price from $ 17 to $ 28 and now calls AMD "equal weight." Every time a big company like Morgan Stanley raises a target price and rating so drastically investors take note and it's no wonder that AMD had a further 8% rise in its shares to $ 31.81. The company is now operating two dollars away from its last year's high of 34.14 dollars, which was seen last September.

AMD has announced and ready to storm the market for its new Ryzen 3000 series, which promise to be a major headache for the Intel Core, and EPYC for the server market. In addition, its new RX 5000 series of graphics cards has already been announced, an agreement with Sony to supply the technology behind PlayStation 5 and the recent announcement of its Radeon GPUs for Samsung products.

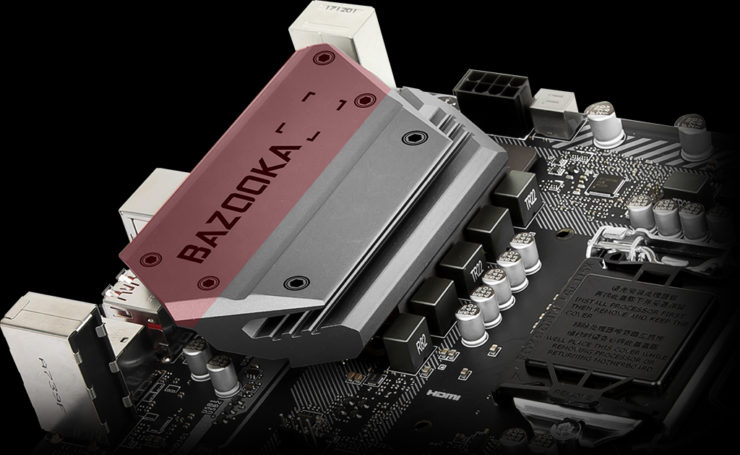

Msi claims his mortar motherboard heatsink performs better than his asus

MSI has compared the design of heat sinks on its motherboards with those implemented on ASUS motherboards. Mortar offers better performance.

Intel shares fall after slashing 2019 forecast

Semiconductor firm Intel reported first-quarter revenue of $ 16.1 billion, almost unchanged year-over-year.

Amd shares rise after launch of ryzen 3000 and navi

A Wall Street analyst raised its AMD share price target due to Ryzen 3000's positive response.